A Closer Look At Simcoe County Real Estate

Unless you’ve been living under a rock, you’ve probably heard that the real estate market has taken a beating here in the second half of 2022. But what does that mean exactly? What are the real challenges people are facing and where are the opportunities? What is really going on here? So glad you asked..... Please have a read below as I shed some light on the darkness the media has been casting on Canadian Real Estate and Simcoe County more precisely.

#1. Housing Prices Have Corrected, Not Crashed

It was just a matter of time to be honest. What was happening this time last year was downright madness and entirely unsustainable. Something needed to change and it did. Around March of this year the shift began to happen. With every interest rate hike the BoC ( Bank of Canada ) announced the market slid further and back towards sustainability. What may have felt like a crash but was a correction. A normalization of housing prices and a balance between Buyer and Seller dominance. The prices were over inflated and now they have adjusted back to pre-pandemic numbers and we should see some reasonable growth year over year. What we found interesting, and you may be surprised to know, is that the average home sale price in Simcoe County has been rising every week since the middle of August. In addition to this, the ratio between the original asking price and the sale price of a home has gone up approximately 2% after falling incredibly from the peak. ( Peak = 117% of asking price. Lowest this year = 93 % of asking price. Now = 95% of asking price. ) The average price has stabilized around $780,000.00 which is up from the low this year of $751,000.00.

#2. What About Interest Rates?

The news of interest rates rising strikes fear in the masses and causes people to either rush in to beat the increases or throw the gear shifter into park and apply the hand brake. Mostly the latter. These rate hikes have done two things to our market. One, it's taken some people right out the market from an affordability standpoint as they can no longer qualify to buy the average home with the new rates. Two, many buyers are in a " let's wait and see how much lower prices are going to go " mindset and they are playing the dangerous game of timing the market. In all seriousness we are actually back to what is considered "normal" interest rates. They have been unusually low for so long now people have become used to them being that way and the rate increase feels uncomfortable. We are optimistic that these rate hikes are over and that there may be a couple more smaller increases before settling into some stability here.

#3. So Is It A Buyers Market Or A Sellers Market?

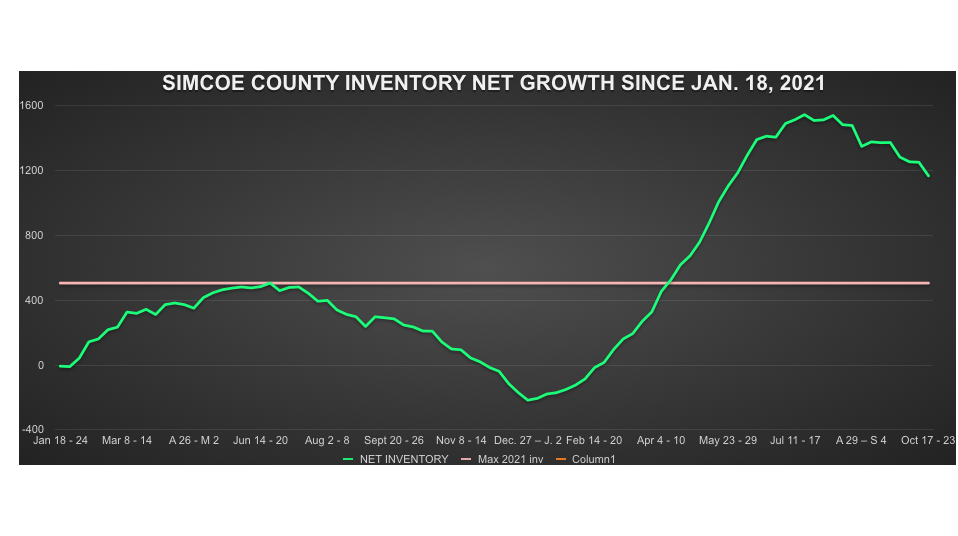

This chart below is an excellent illustration of the difference between a buyers, sellers and balanced market. Take note of the red and green horizontal lines. Anything close to or above the green line is an indicator of a strong, seller dominant market where home owners are in control and can command strong prices and the most favourable terms. Anything close to or below the red line suggests a strong, buyer dominant market where buyers can command the negotiations, get great discounts on pricing and control the terms more. You can see the journey we have been on and how we have moved back over the red line and towards a balanced market. A balanced market is actually a decent time to buy and sell real estate. As a seller you have to be competitive, price your home sharp and slightly ahead of the competition to ensure a reasonably short sale and get closer to your asking price. As a buyer you can shop around a little more. There are choices now and the competition to buy isn't as steep as it was during the peak. You can add into your offer favourable conditions like a financing clause, home inspection and even make your offer conditional on the sale of your existing home! Something we haven't seen in years.

#4. You Can't Time The Market

So many people we talk to have a struggling believe that they can actually time the market. This thinking is likening the real estate market to day trading the stock market. I will say this here once and loud!! YOU CAN"T BUY LOW AND SELL HIGH!! It's nearly impossible and it's foolish to think you can. This is your home. It's where you live. Is it an investment? Sure. We don't want to lose money on an investment, I get it. I would never advise someone to sell and lose or buy too high and lose. You only lose if you sell your real estate for less than you paid for it. Unless your business and majority of your income comes from buying and selling real estate, you should be buying or selling to change the quality of your life or the lives of the people you care about most. Its the only logical reason to do so. Is it time for a lifestyle change? Yes. Do you have equity in your home? Yes. Can you afford to buy the home you want and need? Yes. THEN GO OUT AND BUY THE HOME AND SELL YOUR EXISTING ONE FOR THE PRICE THE MARKET WILL PAY! Regardless of what the market is doing and especially if your plan is to stay there for a minimum of 5 years or more. Ignore the media and the negative press and STOP trying to time the market because you can't.

#5. What's Next For Simcoe County Real Estate?

Ah..... the magic multi-million dollar question. We don't know for sure but there are some clues and some predictions. If we look at the chart below you can clearly see that the inventory (amount of available homes currently for sale ) is beginning to shrink. You might ask, why? It's a combination of things including seasonality, some defeated home sellers that have not listened to what the market is telling them and have overpriced their homes, are cancelling their listings and giving up. The lack of new home sellers entering the market for concerns that now is not a good time to sell and move is also contributing to shrinking inventory. Many have bought into the media misinformation and fear mongering. What we do know, however, is that when inventory goes down, prices go up. It's the law of supply and demand. Now, the demand may drop for the short term as we head into the nasty winter months, but come spring people will want to move for changes in lifestyle and the demand will rise. So will the inventory but how much is the question? If everyone that is singing the " I'm going to wait until spring " song enters the market come March, April & May, we may actually see the market turn back towards a sellers market. Or at the very least a balanced market leaning towards a sellers market. So all those people who were waiting to see what happens and who thought the market was going to drop lower, will now end up in a competitive market with higher prices and less choice. If this prediction is correct, the best time to have bought real estate would have been back in the first two weeks of August this summer. With the lack of new home starts, a demand to live in Simcoe County for so many reasons and a possible tightening of the inventory, we feel it will be a strong market this spring.

Have more questions?

Now that you’ve read our blog post, you should have a better handle on whether or not it’s time to buy, sell or both. Whether the time is now or you plan on waiting a little longer, we're here to help.

Categories

Recent Posts